Agency Pricing Guide: How to Price Your Services in 2025

Your last project just wrapped. The client is happy. But when you calculate the actual profit, something feels off.

You charged $10,000. After salaries, software, and "quick" client emails, your margin is a thin 12%. You kept $1,200 instead of the $3,000 you expected.

Why are you working this hard but barely making a profit? According to HubSpot’s survey of 782 agencies, only 30% of agencies ever break the $1M revenue mark. Most stay small because they price for survival, not scale. They let admin work and unbilled changes eat their margins alive.

You will learn to calculate rates that protect your margins, understand which pricing model fits your agency, and price services that keep you profitable as you grow.

The Hidden Costs Killing Your Margins

Most agencies know their obvious costs. Salaries, office space, computers. But hidden costs destroy profitability. Here's what you are probably missing:

The 'Franken-stack' Tax: Why Separate Tools Kill Margins

Many agencies rely on separate tools for project management, time tracking, invoicing, and communication. This “Franken-stack” often costs $300–$500 per month for a small team:

Project management: $10 to $15 per user

Time tracking: $10 per user

Invoicing software: $15 to $30 monthly

Communication tools: $8 per user

File storage: $12 to $20 monthly

Administrative Overhead: 20% to 30% of total time

Status update emails

Client communication

Invoice creation and follow-up

Internal meetings

Proposal writing

Sales and Marketing: 15% to 25% of revenue

Website and content

Paid advertising

Networking and events

Sales calls and demos

If you are not factoring these into your pricing, every project loses money. Your hourly rate might be $150, but your actual cost is $180. Right?

To fix this, you need to choose the right pricing model for how your agency actually works.

Understanding Agency Pricing Models

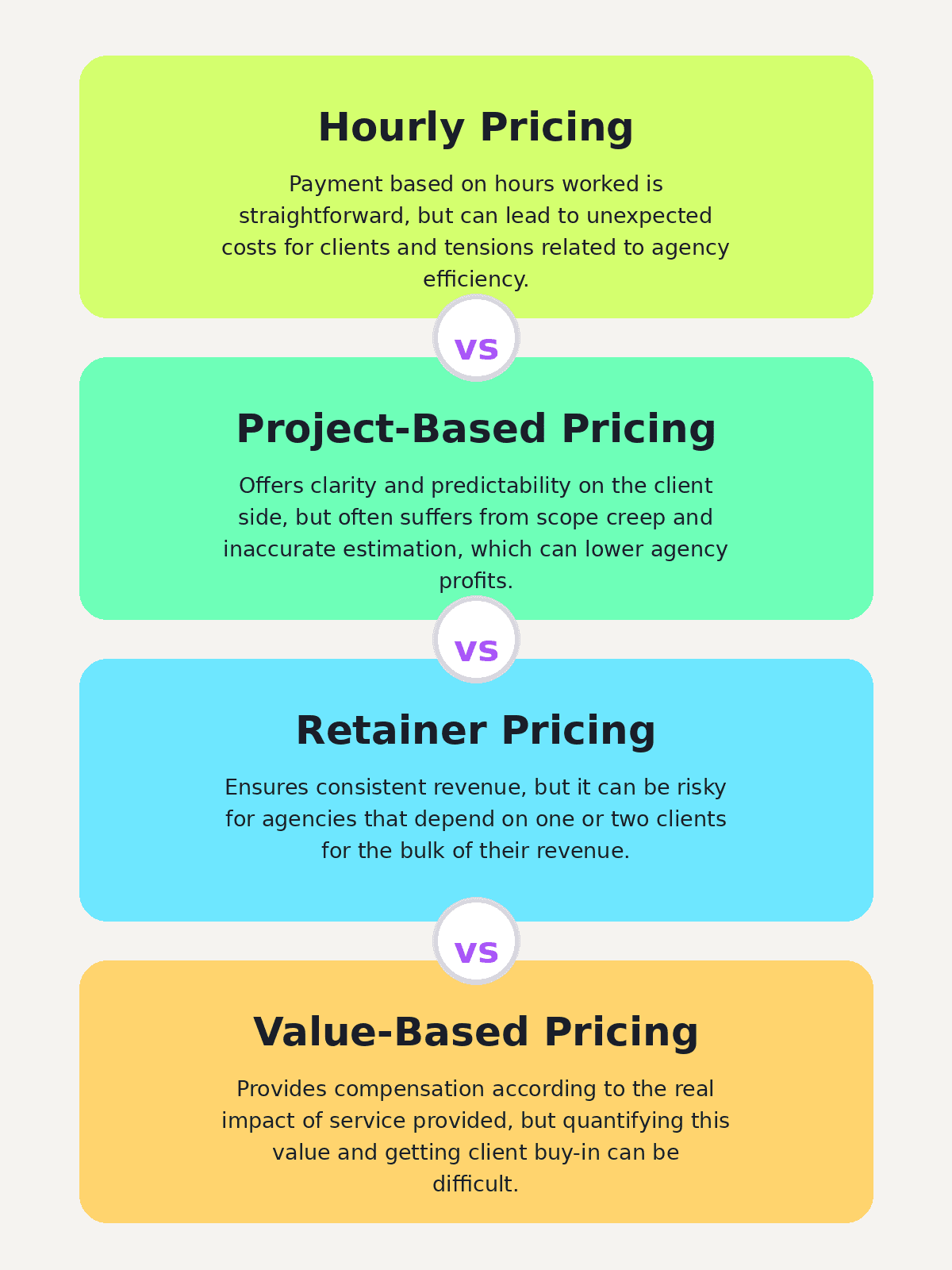

You have four main options. Each works for different situations.

1. Hourly Pricing

You charge for every hour worked. Simple, but can be limiting.

When it works:

Discovery phases with unclear scope

Small, unpredictable projects

New agencies building their portfolio

Typical rates: $75 to $250 per hour

The benefit: Flexible, easy to calculate, and you get paid for all hours worked

Challenge: Efficiency penalizes your earnings, the faster you complete work, the less you earn; clients may question every logged hour

2. Project-Based Pricing

You charge a fixed fee for clearly defined deliverables. Most agencies prefer this model.

When it works:

Clear scope and deliverables

Repeatable internal processes

Fixed timeline projects

Typical range: $5,000 to $50,000+, depending on complexity

The benefit: Clients get cost certainty; efficiency increases profit; better clients prefer fixed pricing

Challenge: Scope creep can erode margins. Always define deliverables clearly upfront

3. Retainer Pricing

Clients pay a recurring monthly fee for ongoing access to your services.

When it works:

Long-term client relationships

Ongoing support, maintenance, or optimization

Predictable monthly deliverables

Typical range: $3,000 to $10,000 per month

Average retainer (2025): $3,209 per month

The benefit: Predictable revenue, easier cash flow planning, stronger client relationships

Challenge: Requires a consistent pipeline, losing even one client can hurt planned revenue

4. Value-Based Pricing

You charge based on outcomes delivered, not hours worked.

When it works:

Measurable business outcomes

Strategic or advisory consulting

Established agencies with proven results

Typical range: 10% to 30% of the value created

The benefit: High profit potential; aligns incentives with clients; rewards outcomes rather than effort

Challenge: Requires confident positioning and strong trust; clients must believe in your ability to deliver results

Quick Comparison

Pricing Model | Predictability | Profit Potential | Client Preference |

|---|---|---|---|

Hourly | Low | Low-Medium | Mixed |

Project | Medium | Medium-High | High |

Retainer | High | Medium | High |

Value-Based | Medium | Highest | Low-Medium |

Most successful agencies use combinations. Hourly for discovery. Project-based for delivery. Retainer for ongoing support.

How to Calculate Your Hourly Rate

Even if you charge per project, you need to know your hourly cost. This determines whether your quotes are profitable.

The Formula

(Annual Salary + Overhead) × Markup ÷ Billable Hours = Hourly Rate

Real Example: Developer on Your Team

Step 1: Base Salary

Annual salary: $80,000

Step 2: Calculate Overhead (40% multiplier)

Payroll taxes and benefits: $20,000 to $24,000

Software and tools: $3,600 annually

Equipment and setup: $2,400 annually

Insurance and legal: $1,500 annually

Total overhead: $32,000

Total cost before profit: $112,000

Step 3: Apply Markup for Profit

Most agencies use 2x to 4x multipliers. The Conservative approach uses 2.5x.

$112,000 × 2.5 = $280,000 target revenue per developer

Step 4: Calculate Billable Hours

Your developer works 2,080 hours annually (40 hours × 52 weeks). But they're not 100% billable.

Realistic activities:

Team meetings: 10% of time

Admin work: 10% of time

Vacation and sick days: 5% of time

Training and development: 5% of time

Billable utilization: 75% is realistic, 80% is aggressive

2,080 hours × 0.75 = 1,560 billable hours

Your Minimum Rate: $280,000 ÷ 1,560 = $179/hour

Round up for simplicity: $185 to $200/hour

How to Build Your Pricing Strategy?

Healthy pricing isn’t guesswork. It’s a series of deliberate decisions.

1. Choose your market position

Premium:

Higher prices

Fewer clients

Strong margins

Competitive (most agencies):

Market-aligned pricing

Strong processes

Industry specialization

Competing primarily on price creates fragile businesses.

2. Quantify client value

Pricing strengthens when value is clear:

A 2% conversion lift may mean $100k in new revenue

A product launch may unlock a new revenue stream

A campaign may generate a $200k sales pipeline

Value anchors pricing better than hours ever will.

3. Understand your cost structure

Fixed costs: salaries, tools, insurance

Variable costs: contractors, licenses, infrastructure

High fixed costs require consistency. High variable costs reduce risk but pressure margins.

4. Set margin targets

Average agencies: 15–20%

High performers: 25–35%

Set your margin goal first, then work backward to pricing.

Current Market Rates by Agency Type

Here's what agencies actually charge in 2025.

Agency Type | Hourly Rate | Project Range | Monthly Retainer |

|---|---|---|---|

Web Design | $100–$175 | $8k–$100k+ | $3k–$8k |

Mobile App | $125–$200 | $25k–$250k+ | $5k–$15k |

Digital Marketing | $75–$150 | $3k–$30k | $2.5k–$10k |

Software Development | $150–$250 | $50k–$500k+ | $10k–$30k |

“According to the 2025 Agency Benchmark Report by Agency analytics , average retainers across digital agencies rose 8% YoY, driven by software cost increases and talent competition and top 10% of agencies operate at 30–35% net profit margins.

Pricing Mistakes That Cost You Money

1. Underpricing to Win Clients

Low prices attract the wrong clients and lock you into weak margins. It’s hard to raise rates later, and quality suffers.

Fix: Start at market rates. Sell value, not discounts.

2. Incomplete Cost Math

Many agencies price using visible costs only. The rest quietly eats into profit.

Fix: Base pricing on the true cost of delivering work.

3. Treating Internal Time as Free

Meetings, coordination, and client communication still cost money even if they’re not billable.

Fix: Price assuming realistic billable time, not perfect utilization.

4. Never Raising Prices

Costs go up every year. Prices often don’t.

Fix: Review rates regularly and adjust as your costs and value increase.

The Silent Profit Killer: Revenue Leakage

Most agencies don’t lose money because their pricing strategy is wrong.

They lose money after the strategy is set, when work isn’t fully captured.

Revenue leakage happens in delivery: calls that run long, Slack threads that turn into production work, and PM time spent managing scope instead of logging it. These hours never make it to the invoice, quietly eroding margins.

When pricing seems reasonable but profits still fall short, the problem isn’t the model.

It’s missing or incomplete delivery data.

Tools That Support Better Pricing

Accurate pricing depends on accurate delivery data.

If you don’t know how long work actually takes, pricing becomes guesswork, even with a sound strategy.

Most agencies lose track of data because they rely on multiple disconnected systems:

Asana or Monday for projects

Harvest or Toggl for time tracking

QuickBooks or FreshBooks for invoicing

This creates three challenges:

Team members resist logging time in multiple tools, making data unreliable

Multiple subscriptions increase costs and fragment information

Manual transfer of hours wastes time and causes missed billing

Time Tracking Is Non-Negotiable

Tracking time consistently shows which projects are profitable, which clients consume excessive effort, and which hours are going unbilled. Without it, even the best pricing model fails to capture true profit.

Integrated Solutions Save Money and Time

Your profitability improves when tools work together.

What integration does:

Time tracking feeds directly into invoicing

No manual data entry or copying

Project management includes client portals

Status update emails drop by 80%

The cost difference matters:

Traditional approach (separate tools):

Monday : $12/user/month × 10 = $120

Harvest: $10/user/month × 10 = $100

QuickBooks: $30/month

Total: $250/month or $3,000/year

Integrated platform approach:

Total: $1,188/year

Difference: $1,812 annually

For that 10-person agency, this saves $181 per person annually and 150 to 250 billable hours, equivalent to $22,500–$37,500 in recovered revenue.

When time, work, client communication, and invoicing are connected, agencies can see true project costs, making pricing accurate instead of assumed.

Note: Pricing and tool comparisons are based on public data available as of 2025. Always verify current pricing before finalizing budgets.

Frequently Asked Questions (FAQ's)

1. How do I calculate my agency's hourly rate?

Use this formula: (Salary + Overhead) × Markup ÷ Billable Hours

Example: ($80,000 + $32,000) × 2.5 ÷ 1,560 hours = $179/hour minimum

2. Which pricing model works best for tech agencies?

Most tech agencies succeed with project-based pricing for defined deliverables. Use retainers for ongoing relationships. Reserve hourly pricing for discovery phases only.

3. How often should I raise my prices?

Review pricing every six months. Raise prices annually at a minimum. Increase rates when costs change by 10% or more. Raise prices for new clients every 12 to 18 months.

4. Should I charge hourly or per project?

Project-based pricing works better when you have predictable processes and clear deliverables. It rewards efficiency and gives clients cost certainty. Use hourly only when the scope is unclear.

5. How do I justify higher prices to clients?

Focus on value delivered, not hours spent. Show ROI through case studies. Demonstrate your process and expertise. Position against results, not against competitor rates.

Start Pricing for Real Profitability

Your pricing strategy determines whether your agency thrives or struggles. Underpricing doesn't just hurt this quarter. It attracts demanding clients, burns out your team, and prevents investment in growth.

Action steps:

Calculate your true hourly cost, including all overhead

Apply a 2.5x to 3x markup for healthy margins

Compare your result to market rates for your services

Choose a pricing model that fits your delivery process

Review and adjust pricing every six months

Stop leaving money on the table. Start with the hourly rate calculation. You'll likely discover you're charging 20% to 40% below what you need for sustainable profitability.

What's your current effective hourly rate? Calculate it now and see if it supports your target margins.

Share :